2017 exemption malaysia wallpaper. The following income categories are exempt from income tax.

You are entitled to tax exemption not exceeding three times in a year for leave passage within Malaysia and one leave passage outside Malaysia not exceeding RM3000.

. 2 Order 2017 has effect for the year of assessment 2017 and year of assessment 2018. Withholding Exemptions For tax years beginning after December 31 2017 nonresident aliens cannot claim a personal exemption deduction for themselves their spouses or their dependents. What comes as a surprise to many is the 50 tax exemption on rental income received by Malaysian resident individuals.

A 323 dated 23 October 2017 exempts non-resident person from payment of income tax in respect of income from services which are rendered and performed by the person outside Malaysia. Transaction type to be used is X exemption for import duty exemption and OE other for sales tax exemption. Apr 24 2017 Simply RegisterSign In to access the free content across the portals.

32017 CLARIFICATIONS ON EFFECTIVE DATE OF INCOME TAX EXEMPTION NO. APPENDIX 5 a Tourism Tax Exemption Amendment Order 2019. Income Tax Exemption No.

The Fees would be subject to Malaysian withholding tax at the statutory rate of 10 under Section 109B of the Act if the Fees are deemed to be derived from Malaysia. 9 Order 2017 The above order gazetted on 24 October 2017 exempts a NR from payment of tax on income under sections 4Ai ii which is rendered performed outside Malaysia. Income tax exemption for 2017-2018.

Sales tax shall not be levied based on the provision under Section 57 a i of the Sales Tax Act 2018. Tourism Tax Digital Platform Service Provider Exemption Order. 7 December 2017 As an initiative to increase home-ownership for the nation the Prime Minister in the Budget 2018 has allocated RM22 billion to the housing development in Malaysia.

Review of corporate income tax rate for Small and Medium Enterprises SMEs and Limited Liability Partnerships LLPs The income tax rate for SMEs and LLPs on chargeable income of up to RM500000 is to be reduced from 19 to 18. Exempt a tourist from paying the tax an operator from collecting the tax or from needing to register for TTx. Conditions for a SME company.

Tourists who are exempt from payment of the tax a Malaysian National. A 3232017 services performed outside Malaysia before and after this Income Tax comes into operation falls under paragraphs 4Ai and 4Aii of the Income Tax Act 1967 the Act are not subject to withholding tax under section 109B if such services are PRACTICE NOTE NO. In effect this reverts to the previous position such that intellectual property services such as trade mark industrial designs and.

9 Order 2017 the PU order published in the official gazette on 24 October 2017 and deemed to have come into operation on 6 September 2017 which restores the withholding tax exemption for offshore technical and installation services carried out by. 1 Leave Passage Vacation time paid for by your employer in two categories. Malaysia Withdraws Tax Exemption On Foreign Sourced Income Remitted To Malaysia And Introduces A One Off Prosperity Tax Commonwealth Association Of Tax Administrators.

The exemption from income is in respect of. Effective dateServices rendered from 6 September 2017. Prior to 17 January 2017 the.

Malaysias Minister of Finance MOF has issued Income Tax Exemption No. A 522017 shall be entitled to enjoy the income tax exemption automatically and shall not have to obtain the approval of the Director General of Inland Revenue. The WHT provisions under section 109B would not apply to the above income.

The government released an Exemption Order the Order on 10 April 2017 providing a temporarily reduction in corporate income tax rates based on incremental taxable income compared to the preceding year of assessment. Learn about the withholding exemption and special instructions for nonresident alien employees completing Form W-4. Import duty exemption can be claimed under item 55 Customs Duties Exemption Order 2017.

The Income Tax Exemption No. Malaysia Tax 24 October 2017 Tax Espresso Special Alert Withholding tax exemption on offshore services The Legislation Position from 17 January 2017 onwards Effective 17 January 2017 Section 4Ai and ii withholding tax WHT at the rate of 10 is re-imposed on payments to non-residents for offshore services ie services. Tax exemption malaysia 2017.

RELIGIOUS INSTITUTION OR ORGANIZATION A religious institution or organization means a religious institution or organization-. Tourism Tax Rate of Digital Platform Service Provider Tax Order 2021. The Minister of Finance has granted withholding tax exemption WHT on payments to non-residents that fall within Section 4Ai and ii of the Income Tax Act in respect of offshore services via the Income Tax Exemption No.

Tourism Tax Exemption Order 2017. The exemptions are contained in the Tourism Tax Exemption Order 2017 and the following parties have been exempted. Effective 6 September 2017 the Government through the Income Tax Exemption No9 Order 2017 PU.

LHDN01354251179-1 Page 2of 4 3. The above is applicable to. Or b A Permanent Resident of Malaysia.

1 Nov 2018 Budgeting Inheritance Tax Finance

What Bloggers Influencers And Freelancers Need To Know About Taxes In Malaysia Blogjunkie Net

Tax Relief For Year Of Assessment 2018 Plctaxconsultants

Individual Income Tax In Malaysia For Expatriates

2020 Tax Relief What To Claim For Your Tax Deductions R Malaysia

Pdf Factors Affecting Tax Compliance Behaviour In Self Assessment System

Guide To Tax Clearance In Malaysia For Expatriates And Locals Toughnickel

Pdf Determinants Of Tax Compliance Among Grabcar In Malaysia

2022 Updates On Real Property Gain Tax Rpgt Property Taxes Malaysia

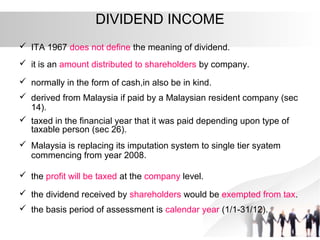

Taxation Principles Dividend Interest Rental Royalty And Other So

Malaysia Issues Tax Exemption For Foreign Sourced Income

The Gobear Complete Guide To Lhdn Income Tax Reliefs Otosection

The Gobear Complete Guide To Lhdn Income Tax Reliefs Otosection